The first step involves a financial diagnostic to be completed by the client (found here) and submitted along with current account statements. Once received, an initial meeting is scheduled 2-6 weeks later.

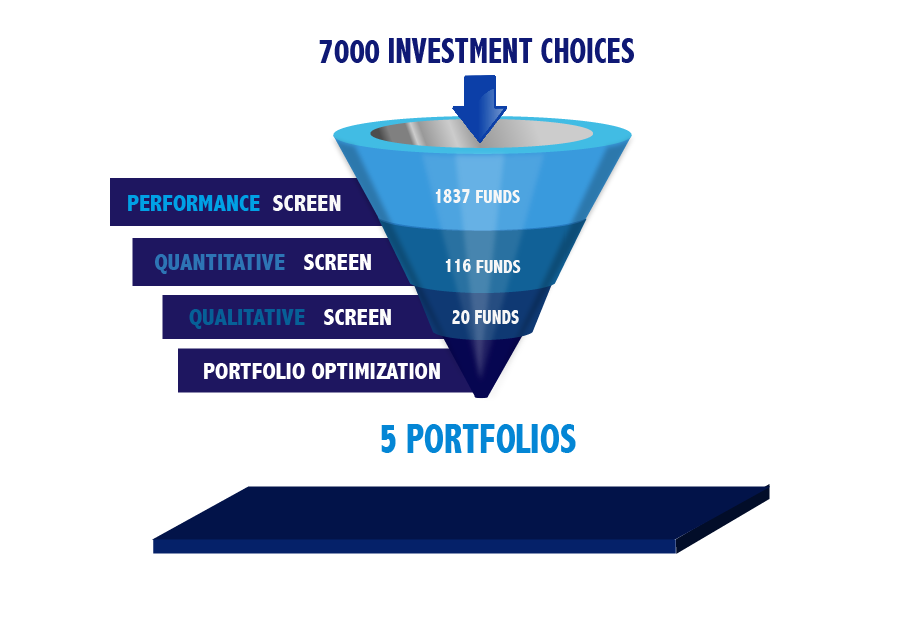

At the initial meeting, we will learn more about the client’s unique situation, as well as their history of investing and personality around money and investments. We will then present a customized investment management plan, with specific expectations for asset growth.

Investment will then take place in a conservative fashion, with full implementation taking place over 6 months. No less than quarterly, clients receive YourTrack account statements to compare their accounts’ performance with defined short and long-term objectives.

Collaborate to agree on specifically what your investments need to accomplish for you.

EQUITY

EQUITY

INCOME

INCOME

ALTERNATIVES

Bootstraptaste